GCC's e-commerce sector surging ahead thanks to Covid-19

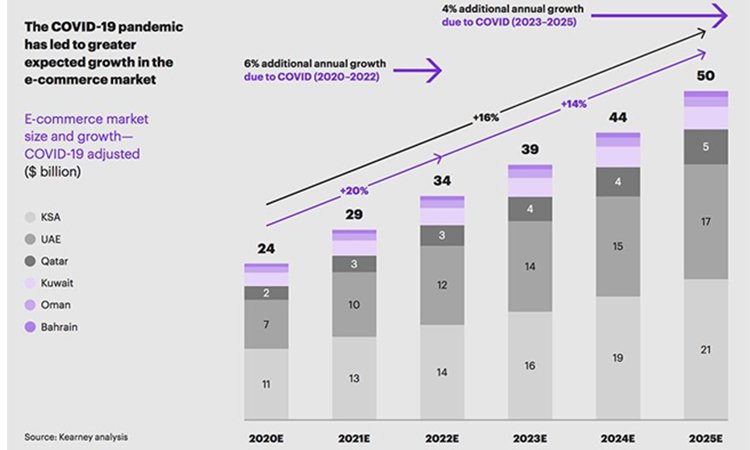

The Covid-19 pandemic has significantly altered consumer behavior and business operations worldwide. One of the most notable changes has been the surge in e-commerce, particularly in the Gulf Cooperation Council (GCC) region. The shift towards online shopping has accelerated rapidly, driven by the necessity of social distancing and lockdown measures. This blog delves into how Covid-19 has propelled the GCC's e-commerce sector forward and the role of ecommerce software, ecommerce site builders, and ecommerce development services in this transformation.

The Impact of Covid-19 on GCC's E-Commerce Sector

- Increased Online Shopping

The pandemic has led to a dramatic increase in online shopping across the GCC. With physical stores closed or operating under restrictions, consumers have turned to e-commerce platforms to purchase essentials, groceries, and other goods. This shift has been facilitated by the availability of ecommerce software and ecommerce site builders that enable businesses to quickly set up and manage online stores.

- Surge in Digital Payments

As more consumers shop online, the use of digital payment methods has surged. Secure payment gateways like PayPal, Stripe, and Razorpay have become essential for e-commerce platforms, ensuring safe and convenient transactions. The increase in digital payments has also been supported by the integration of ecommerce software that provides robust security features.

- Adoption of Mobile Commerce

With the rise in smartphone usage, mobile commerce has gained significant traction in the GCC. E-commerce platforms with responsive design and mobile-friendly features have seen a substantial increase in traffic and sales. Ecommerce site builders like Shopify and BigCommerce offer mobile-responsive templates that enhance the shopping experience on smartphones and tablets.

- Expansion of Delivery and Logistics Services

The demand for efficient delivery and logistics services has grown alongside the rise in online shopping. E-commerce businesses have partnered with delivery service providers to ensure timely and safe delivery of products. This expansion has been supported by advanced ecommerce software that streamlines order processing and fulfillment.

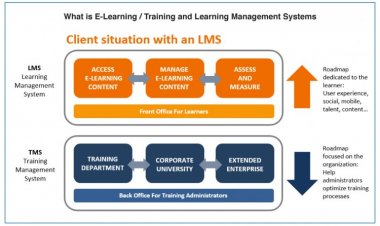

Role of Ecommerce Software in the GCC's E-Commerce Boom

- Streamlined Operations

Ecommerce software has played a crucial role in streamlining the operations of online stores. From inventory management and order processing to customer relationship management (CRM) and marketing, ecommerce platforms integrate various functionalities to ensure a seamless workflow.

- Enhanced Customer Experience

Providing an exceptional customer experience is key to retaining online shoppers. Ecommerce software includes features like personalized recommendations, secure payment gateways, and efficient customer support tools that enhance the shopping experience. These features have become even more critical during the pandemic as businesses strive to meet the increased demand for online services.

- Scalability

The surge in e-commerce has required businesses to scale their operations quickly. Ecommerce development services offer scalable solutions that allow businesses to expand their product range, increase their market reach, and handle higher volumes of traffic and transactions.

- Advanced Analytics and Reporting

Understanding customer behavior and sales trends is essential for making informed decisions. Ecommerce software provides advanced analytics and reporting tools that offer valuable insights into e-commerce operations. This data helps businesses optimize their strategies and improve overall performance.

Benefits of Ecommerce Development Services

- Custom E-Commerce Website Development

Ecommerce development services offer tailored solutions to meet the unique needs of businesses. Custom e-commerce website development ensures that online stores are designed to reflect the brand identity and cater to specific customer preferences.

- Integration Services

Seamless integration with other business systems, such as ERP and CRM, is vital for efficient e-commerce operations. Ecommerce development services provide integration solutions that connect various systems, ensuring a cohesive and streamlined workflow.

- Ongoing Support and Maintenance

Maintaining an online store requires continuous support and maintenance. Ecommerce development services offer ongoing assistance to ensure that the platform runs smoothly, addressing any technical issues that may arise.

- Marketing and SEO Tools

Effective marketing and SEO are crucial for attracting and retaining customers. Ecommerce development services include features like email marketing, social media integration, and search engine optimization to drive traffic to the online store and improve its visibility.

Conclusion

The Covid-19 pandemic has significantly accelerated the growth of the GCC's e-commerce sector. The increased reliance on online shopping, digital payments, and mobile commerce has driven the need for robust ecommerce software, ecommerce site builders, and ecommerce development services. By leveraging these tools and services, businesses in the GCC can enhance their online presence, streamline operations, and provide an exceptional customer experience. Understanding the impact of Covid-19 on e-commerce and the benefits of an all-in-one ecommerce solution is crucial for achieving long-term success in the digital marketplace.

Schedule a Free Demo for Ecommerce Software Development: See our Ecommerce software solutions in action. Schedule a free demo and learn how our features can drive your business's success.

RIbsadmin

RIbsadmin